ESG (environmental, social and governance) investing is one of the fastest-growing investment strategies in the United States. The $12 trillion ESG market wields significant power — representing approximately one out of every four dollars in total assets under management. Also known as socially responsible or impact investing, the ESG movement is led by millennials and Generation Xers; a critical audience as more than $30 trillion in wealth is expected to transfer from baby boomers to younger generations over the next three decades.

Fund issuers, asset managers and advisors are racing to meet investor demand for ESG options, creating an extremely competitive market. So far in 2019, nearly 100 funds have added “ESG” language to their prospectuses, while the number of ESG funds increased by 50% in 2018 alone. As the ESG market continues to grow, issuers and managers are faced with the challenge of differentiating their ESG products in an already crowded marketplace in order to appeal to investors.

Unfortunately, this fierce competition has resulted in a practice known as “greenwashing” — conveying a misleading or false impression that a product or company is more environmentally sound than it actually is. Greenwashing has made it very difficult for investors to differentiate truly sustainable funds from those simply jumping on the ESG bandwagon.

Whether you are an ETF issuer looking to launch an ESG fund or an RIA aiming to help clients incorporate sustainable assets into their portfolios, below are four tips to incorporate into your marketing and public relations strategy to avoid greenwashing and ensure you are appropriately conveying your unique value in the sustainable investing marketplace.

1) Identify your key differentiators

Most ESG funds have a similar investment objective — to invest in companies that are environmentally sustainable or socially conscious. In order to stand out from competitors, clearly identify what makes your fund unique in your marketing materials. Impact Shares, the first nonprofit ETF issuer in the United States, is a great example of an issuer that has clearly differentiated its investment thesis in the marketplace.

In addition to being the first ETF issuer of its kind, Impact Shares partners with leading social advocacy organizations such as the YWCA, NAACP and the United Nations Capital Development Fund to help translate social issues into investable products. These partnerships add third-party credibility and help to clearly define each ETF’s investment objective, ensuring that holdings meet strict criteria clearly defined by the nonprofit partners. In addition, Impact Shares donates 100% of net advisory fees back to the nonprofits — a win-win for investors looking to make the most of their investment dollars!

2) Narrow your focus

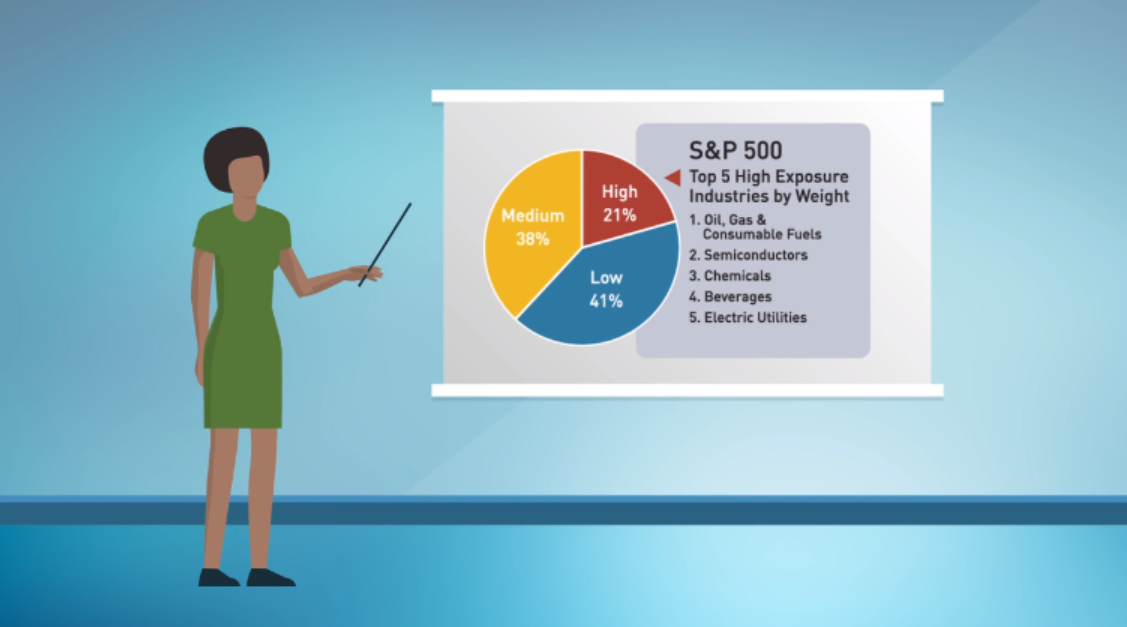

The realm of sustainable investing is massive, covering a range of issues from greenhouse gas emissions to use of plastics and fossil fuels. Don’t try to address every problem in your investment product or solution; narrow your focus to stake your claim as a leader on a specific issue. Develop multifaceted marketing campaigns in support of your position on the issue, incorporating traditional media relations along with social and video elements to appeal to younger audiences.

Ceres, a leading sustainability nonprofit based in Boston, has placed an emphasis on addressing one of our world’s most precious and at-risk natural resources: water. Over three decades, Ceres has become a thought leader on how companies and investors can help address water scarcity and pollution. By partnering with the world’s leading investors through the Ceres Investor Water Hub and launching tools such as the Investor Water Toolkit, Ceres’ water team has become a go-to resource for investors looking to incorporate water into their portfolios.

3) Highlight ESG winners and losers

Discussing the specific holdings in your fund’s portfolio is one of the best opportunities to highlight your investment strategy in real time. Identify a handful of companies that are publicly making a difference in key environmental and social issues during your conversations with potential investors and the media. Impact Shares CEO Ethan Powell put this concept into practice in September by lauding Amazon’s recent action on climate change in a CNBC.com article.

However, this strategy can also be leveraged from an opposing perspective. Don’t be afraid to address companies that are performing poorly on certain ESG issues and tie it back to your unique approach. Last spring, asset manager Nuveen had the opportunity to discuss in Barron’s how its ESG strategy helped the firm avoid Kraft Heinz’s “stock bloodbath” stemming from a company accounting scandal.

4) Emphasize strong performance

At the end of the day, while investors are starting to prioritize environmental, social and governance issues, performance is still the most important factor in investment decisions. One of the biggest criticisms of ESG investing is that it does not generate strong returns, despite research indicating the opposite. Take advantage of opportunities to discuss how ESG can lead to superior long-term performance, highlighting examples of outperformance in your own fund whenever possible.

While some in the investment community may view ESG as a silly acronym, massive inflows into sustainable funds indicate that this rapidly growing portion of the market is here to stay. As we look ahead to a socially responsible future led by younger generations, it’s imperative that fund issuers, asset managers and others start considering how to embrace ESG and position themselves appropriately in the market.